Higher margins & sales for gasoline price protection & C-store discounts

Membership Fee: $25 for 6 months Benefits: 100-gallon price guarantee, discounts on C-store items

Similar to other retail clubs (e.g. big-box retailers) customers pay a membership fee to join your Club. At enrollment, Club members receive a no-risk/no-cost* 100-gallon gasoline price guarantee card valid until the 100 gallons on the card are used up or until the card expires. Members also receive discounts on all or some C-store items.

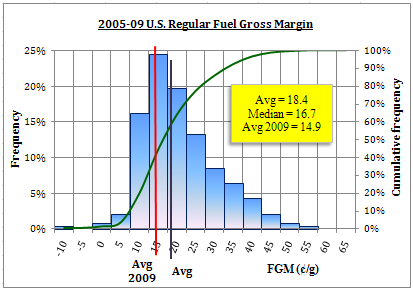

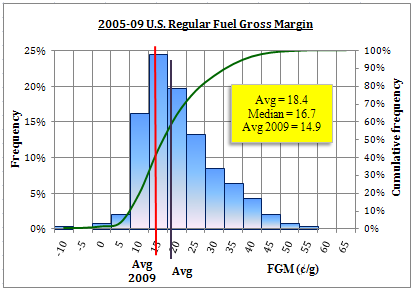

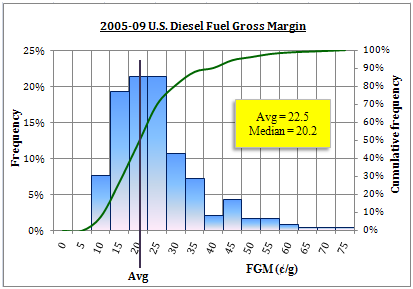

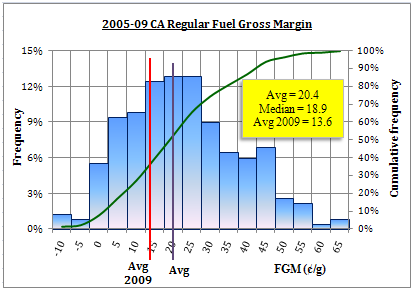

Price guarantees (or caps) are set by retailers based on targeted fuel margins, market prices & expectations, and other factors at the time the cards are issued, applying the Formulas below. Club members pay the price of gasoline on their card when they use it at a participating location in the state or region where it is designated.

If the station owner is a dealer where the Club member uses his card, the station owner receives the pump price, and the customer pays the card price. The difference is covered with part of the gains on its offset. Given price caps are established at high margins (e.g. 25 ¢/g) it is highly likely the gains on offsets more than cover the savings realized by Card owners.

While it would be visually appealing, it is not assumed Club members see pump price rollbacks when using their cards. The Club member sees the guarantee price (e.g. $2.94/gal) applied to the gallons in the transaction on his monthly statement.

* No up-front cost. The member pays the price on the card when the card is used. Therefore, the card is also no-risk/all-gain.

Formulas

Price Lock = Margin target + Futures + Basis + Rack/Spot diff. + Transp. + Taxes

Price Cap = Price Lock + 10 ¢/g **

** The 10 ¢/g is arbitrary but an important difference between the price cap and price lock.

More information on The Club can be found here and here. A detailed Example on how the Club works may be made available on request.

Posted by TJL

Posted by TJL