Transactions in the futures market can be costly and a bit of overkill for some fuel retailers who own or operate only a few stations or whose stations sell less than 100,000 gallons per month. Futures can also be intimidating, even for the “big guys”. In addition, the requirements for opening and funding a futures account to enable futures transactions – and then deciding who has authority to execute and who’s going to track & report the transactions – can be a hassle. Nevertheless, since the futures market is the market driver (see Post #2), a fuel retailer should put him or herself in a position to use the futures market to their and their customers’ advantage. That’s going “on offense” and just smart business.

Fortunately, U.S. Commodity Funds are now available (UGA and UHN for gasoline and heating oil, respectively) that make futures transactions simpler and less costly, but equally effective. UGA and UHN are “mini-futures” that trade like stocks. More precisely, they are exchange-traded securities “designed to track the changes in the price of gasoline [heating oil], as measured by the changes in the price of the futures contract on gasoline [heating oil] traded on the NYMEX, that is the near month contract to expire. UGA’s [UHN’s] units may be purchased and sold on the NYSE.” A copy of the Prospectus for UGA may be obtained here. A Prospectus for UHN is available

here.

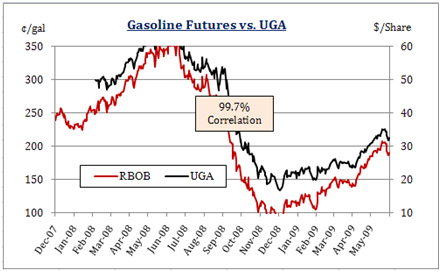

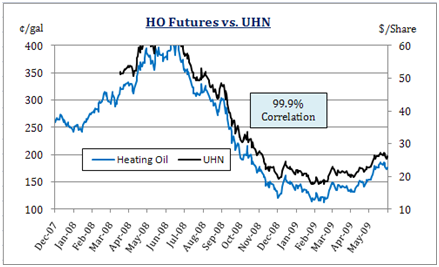

The effectiveness with which UGA and UHN track their futures counterparts is evident in the charts below. The correlations between the funds and their futures counterparts are essentially 100%.

Another advantage of the commodity funds is that they are not month-specific like futures contracts. In effect, owning a commodity fund is like owning “the forward curve” in the futures contract. Buying futures or futures options first involves choosing the futures month, which, of course, eventually expires. At expiration, owners of futures contracts must either liquidate or roll their positions to the next month or thereafter. While rolling futures contracts is not difficult, it is an “administrative” activity that is not required with the commodity funds.

Volume Conversions

One futures contract is 42,000 gallons or 1000 barrels. Calculations show 5.9 shares UGA is roughly equivalent to 100 gallons of RBOB (gasoline) futures and 6.7 shares UHN is roughly equivalent to 100 gallons of HO (heating oil / diesel fuel) futures. That’s why the commodity funds can be called “mini-futures”.

Posted by TJL

Posted by TJL