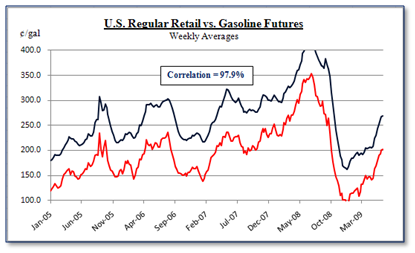

The futures market is the “driver”

Retail gasoline and diesel prices are linked to futures gasoline and heating oil prices. The futures market is the “driver”. This is clear from high correlations (over 96% [1]) over the last five years between retail and futures prices in areas throughout the United States.

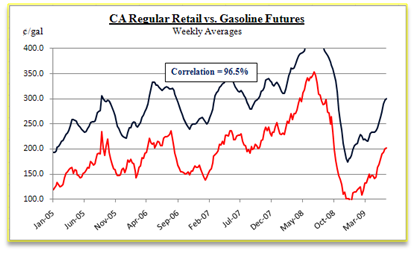

Even in “remote” California …

Data Source: Energy Information Administration

The high correlations between futures prices and retail prices are not coincidental. They result from spot prices in all markets “trading off” futures prices. Spot prices set rack prices that, in turn, set retail prices. Therefore, futures prices set retail prices —

Futures à Spot à Rack à Retail

That fact offers significant opportunities to achieve higher margins & sales (and happy customers) for fuel retailers who are willing to take advantage of it. Is anyone taking advantage of those opportunities now? Gulf Oil is working on it. Pricelock and Petrofix are actively trying. But any fuel retailer can take advantage of the link between futures and retail prices — whether a single C-store owner or a major oil company.

[1] A 96% correlation means 96% of the change in the retail price is due to the change in the corresponding futures price.